At Empire Renewable Energy, we offer various financing options for businesses, nonprofit organizations and homeowners that can help offset the costs of a solar installation. Let us match you with the plan that’s right for you.

No matter how you choose to finance your purchase, Empire Renewable energy can help you acquire favorable lease terms and negotiate a comfortable agreement that allows you to maximize your return on investment. Contact our Phoenix office today for more information.

Traditional Financing

Traditional financing such as home equity loans and lines of credit can be used to finance the purchase of a solar installation. Some banks may also offer 100% financing options. Traditional financing offers a number of benefits. Homeowners may qualify to receive the Federal Investment Tax Credit, which offsets the cost of installation by as much as 26%. They may also qualify for a Modified Accelerated Cost Recovery System tax deduction, which accelerates the depreciation of the system for a five-year period.

Leasing

Many businesses choose to lease large assets because of their tax benefits and for the flexibility to adjust to technological advances and evolving company needs. Leases tend to have longer terms and lower monthly payments than traditional financing methods. They also generally involve little to no upfront costs. The lessee can still receive all applicable rebates and tax incentives, and may have the option of buying out their system or refinancing when the lease comes to term.

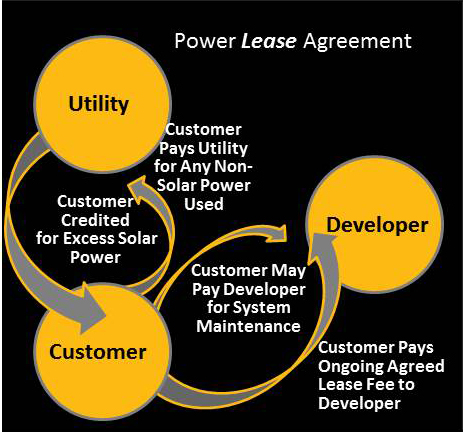

While the terms of each agreement may vary, under a solar lease a building or home owner will typically take more of the risk in exchange for potentially more revenue from the utility if and when their system produces more power than it uses. Under this scenario, the developer may partner with investors to provide financing for the system. Depending on the arrangement, the developer may either package any tax credits for a third party, or (often in the case of businesses) allow the customer to use these tax credits.

While the terms of each agreement may vary, under a solar lease a building or home owner will typically take more of the risk in exchange for potentially more revenue from the utility if and when their system produces more power than it uses. Under this scenario, the developer may partner with investors to provide financing for the system. Depending on the arrangement, the developer may either package any tax credits for a third party, or (often in the case of businesses) allow the customer to use these tax credits.

Generally speaking, there are two different types of leases companies can take advantage of when financing their solar energy systems:

Capital Leases

Capital leases are recognized as both an asset and a liability on corporate balance sheets. Companies can claim depreciation on the system and deduct interest on their loan payments each year. With a capital lease, both parties agree on a bargain or buyout option at the end of the term, at which time the company will gain 100% ownership of the system.

Operational Leases

Operational leases are strict equipment rentals with no buyout option at the end of the term. In an operational lease agreement, you assume no risk and simply return the materials at the end of the lease period. Lease payments can be treated as an operational expense on your income statement and the lease does not affect your balance sheet.

Power Purchase Agreements

Under a power purchase agreement (PPA), a developer organizes the design, permitting, financing and installation of a solar energy system on your property at minimal or no cost at all. The developer then sells you the power generated on your property at a fixed rate that is typically lower than your local utility's electricity rate.

Under a PPA, the developer assumes responsibility for the financing, operation and maintenance of the solar energy system for the duration of the agreement. You will see savings right away, however, they will not be as great as if you financed the system yourself. When your term is up, you can choose to extend the agreement or purchase the system from your developer.

Developers differentiate between two main types of PPA plans: fixed rate and escalator. A fixed rate plan keeps your monthly costs constant for the life of the term, while an escalator plan sets a predetermined rate increase, usually between 2 and 5 percent. Even with an escalator plan, the cost of these agreements generally remains less than typical utility rate increase projections.

While those engaging in a PPA do not directly benefit from available tax credits, they also don’t assume any of the risk or initial expense of installing their system. In the end, a PPA does tend to increase the long-term value of a home or building.

Get started with empire today

Empire’s 70 year commitment to quality products, excellent service and superior workmanship ensures you'll get the right installation for your needs. Our expertise allows us to size a system that is best for you and with SunPower modules powering it all, you'll enjoy a 40-year lifespan and superior lifetime production, which means first-rate return on investment. Contact us today for a professional site assessment.